Reliable data is crucial to make informed tax determinations, more so if automated. If processes upstream capture and record information accurately and consistently, tax automation can deliver as expected.

The reality is just different. Process and documentation gaps, system flaws or human oversights create incomplete or bad data, or miss some details, which can significantly impact the bottom line and tax compliance.

But you don’t know what you don’t know. That’s where TaxTract comes into play by scanning invoices and contracts for tax data.

TaxTract brings a second set of eyes on raw documents by pulling images and extracting any data of interest for Tax.

(Ro)bot browses invoice portal(s) to retrieve captured data and stored documents

Extract predefined and custom tax-relevant information found in documents (pdf, picture, xl, doc)

Compare with SAP and redetermine the tax using correct information.

Report impact on compliance, recommend actions and generate SAP corrections.

What we look for

- Total – to detect short-payments (without tax)

- Subtotal – to crosscheck that we have captured the taxes correctly

- Taxes – by geography (e.g. US States), by type (e.g. Canada) or by rate (e.g. VAT)

- Ship-to / Performed at – address gets verified with USPS and International Address Validation API

- Ship-from – if present. For tax at origin or to tag as local supply

- Tax ID(s) – Can provide hints on place of taxation and type of tax to expect. Useful to feed SAP vendor master.

- Location hints – detect airport and custom location codes that hint at different or multiple place(s) of taxation

Other documents:

- Invoice attachments – tax details buried in the documentation by (un)disclosed agents to detect double tax

- Contracts – context where tax language is used

What we detect

- Tax on Tax – sales tax not recorded. Use tax on total invoice

- Double Tax – short-paid, use tax accrued, sales tax paid separately to vendor – possibly with use tax accrued thereon

- Overpayment – short-paid, use tax larger than sales tax

- Underpayment – short-paid, use tax smaller than sales tax and no line exempt

- Tax not reversed – short-paid, sales tax paid separately, invoice reversed but not the tax

- Duplicate – same invoice, same image, duplicate tax (and payment)

- Wrong jurisdiction – ship-to on PO and invoice image different

- … contact and challenge us to extract more for your use case !

Other transactions of interest: location hints not matching PO, multiple ship-to in SAP with mix of sales and use tax, no tax on local supply, … We review manually suspects which are material to improve detection algorithms or train machine learning models.

What we provide

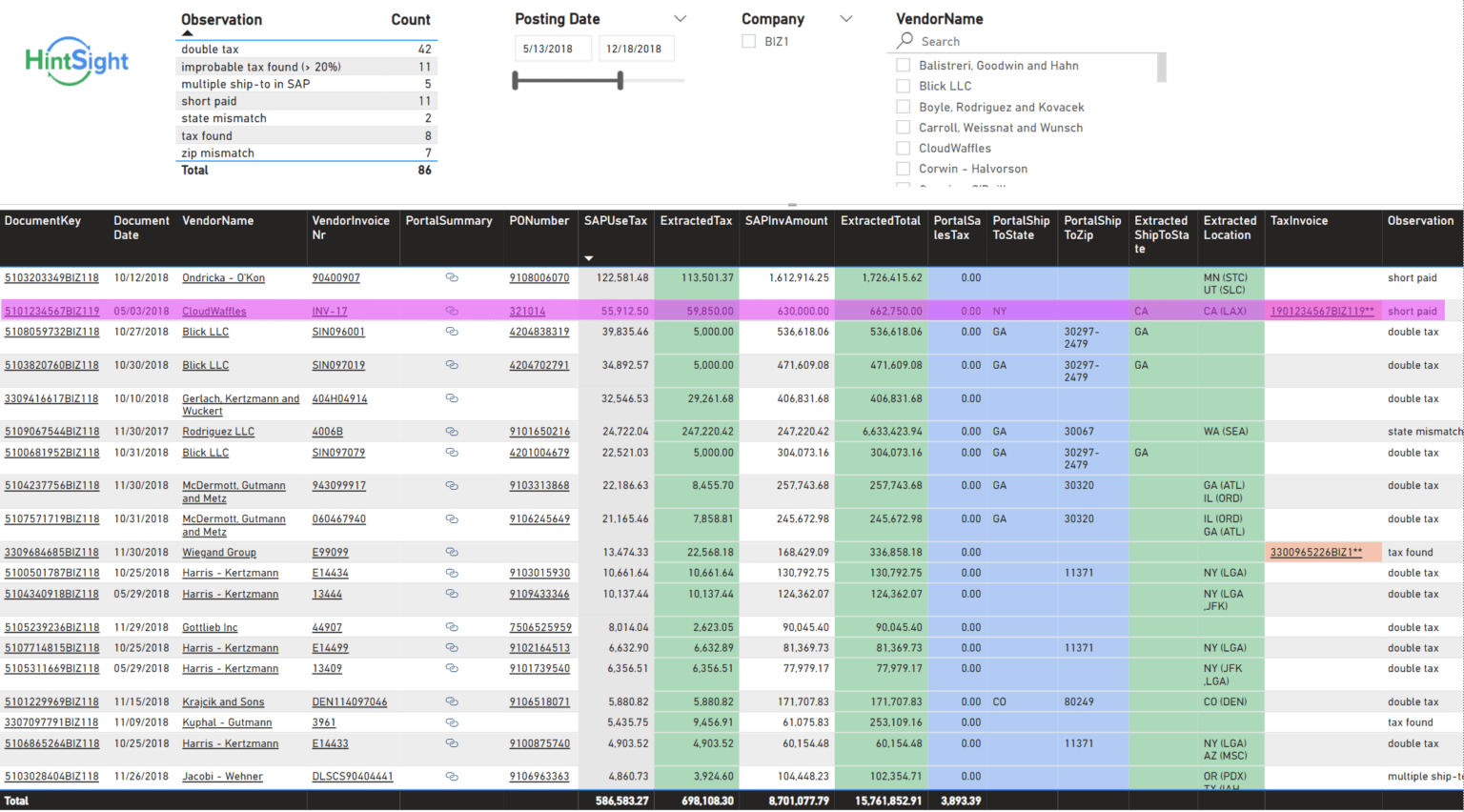

See below a snapshot of the dashboard we provide – in Power BI, Excel or any BI tool.

- Hyperlinks allow to see side-by-side in browser either the invoice image or the relevant SAP GUI screen for more context

- To illustrate, highlighted transaction shows it got short-paid with use tax accrued but sales tax still paid later (moreover with use tax thereon).

Recommended actions: reverse $56K and the use tax on the tax invoice + learn why vendor/user did not capture the sales tax and incorrectly the ship-to

Once gaps are addressed or mitigated, you can then subscribe to TaxTract for a fixed fee for monthly control.

Or better, choose to be alerted by email or chat to take action on exceptions before invoices get transferred and posted to SAP.